Oklahoma law grants a lien (referred to as a “Mechanics and Materialmen Lien” or “M&M Lien”) to any person or company who performs labor or furnishes materials or equipment as part of work to improve privately-owned real property (or its improvements). This is true only so long as the materials or equipment are supplied under an oral or written agreement with the owner of the property. Lien rights also extend to those who supply labor, materials or equipment without a direct contractual relationship with the owner of the property (e.g., subcontractors and supply houses), so long as the work is performed or the materials are supplied in furtherance of the general contractor’s (called the “Original Contractor”) oral or written agreement with the owner of the property.

The lien right comes into existence automatically when labor is performed or materials or equipment are supplied. However, in order to preserve the lien, the person or company claiming the lien must timely file a lien statement in the land records of the county where the property is located. In addition, under certain circumstances, the person claiming the lien must, prior to filing the lien statement, serve a pre-lien notice. This system of lien statements and pre-lien notices, and their associated time limitations, is designed to give contractors, sub-contractors, and suppliers a mechanism to protect their ability to get paid while also protecting property owners from the risk of paying for the same work or materials twice (i.e., paying a dishonest general contractor who fails to use the funds to pay sub-contractors).

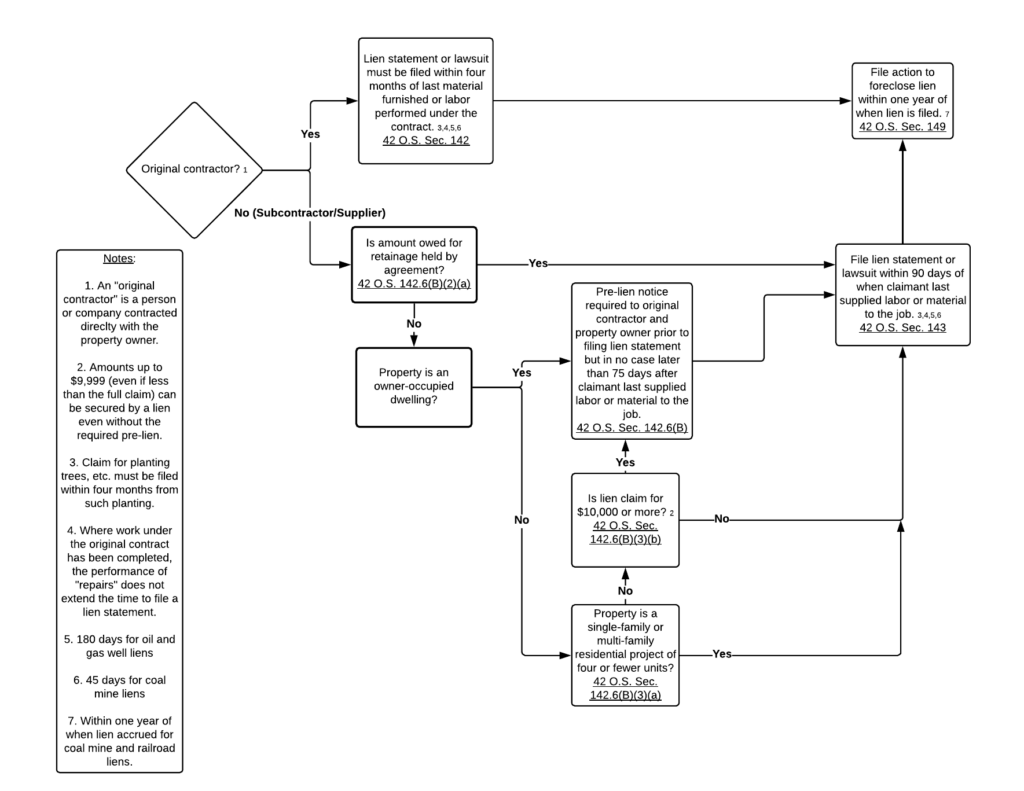

Because Mechanics and Materialmen Liens are a creation of statute, the requirements of the applicable statutes must be closely followed or the lien right can be lost. While the applicable statutes can be confusing and difficult to follow, the following flowchart is a helpful representation of the critical requirements for preserving a Mechanics and Materialmen Lien in Oklahoma:

In addition to meeting the filing and notice requirements depicted above, the pre-lien notice and the lien statement must contain certain statutorily-required elements to be enforceable. The pre-lien notice, if required, must contain the following elements:

- A statement that it is a pre-lien notice

- The complete name, address, and phone number of the lien claimant (or their representative)

- The date of supply of the materials, services, labor or equipment

- A description of the material, services, labor or equipment

- The name and last-known address of the person who requested that the claimant provide the material, services, labor or equipment

- The address, legal description, or location of the property to which the material, services, labor or equipment has been supplied.

- The dollar amount of the material, services, labor, or equipment furnished or to be furnished

- The signature of the claimant or their representative.

The pre-lien notice should be hand-delivered to the owner (supported by a delivery confirmation receipt) or mailed by certified mail, return receipt requested.

The lien statement must be filed timely with the appropriate county clerk and must contain the following elements:

- The amount claimed and a description of the labor/materials provided

- The name of the property owner

- The name of the lien claimant and the name of the Original Contractor (if different from the claimant)

- The legal description of the property

- The verified signature of the lien claimant or their representative

The loss of a lien right does not necessarily mean that a debt is not still owed to the contractor, sub-contractor, or supplier, but payment of the debt is no longer secured by a lien; the debt itself may still be enforceable and collectible by other means (e.g., a lawsuit filed against the property owner). The advantage of holding a lien, however, is that it gives the lien holder the right to foreclose on the lien and force a sale of the property, with the lien holder having a priority claim (as against all liens created after the start of the work) to the proceeds from the sale of the property. Without a lien, the contractor, sub-contractor, or supplier would be required to obtain a judgment against the property owner and then execute the judgment the same as any other general creditor (and, should the property owner file for bankruptcy protection, the judgment could become uncollectable).

1 Lien rights do not extend to work on lighting rods or to leased or rented equipment used on homestead property, on property used for agricultural purposes or for the production of or growing of agricultural products, or, with limited exceptions, to such equipment used for the development or production of oil or gas. Title 42 O.S. §§ 143.3, 143.4 and 151.

2 Lien rights are also available for work on oil and gas wells. Title 42 O.S. §§ 144-146.

3 Contracts with tenants may result in a lien against certain improvements, but not the land. Title 42 O.S. §§ 141-155.